FHA Portfolio Retention Program (PRP)

Artificial Intelligence (A.I.) and Automated Workflow Process

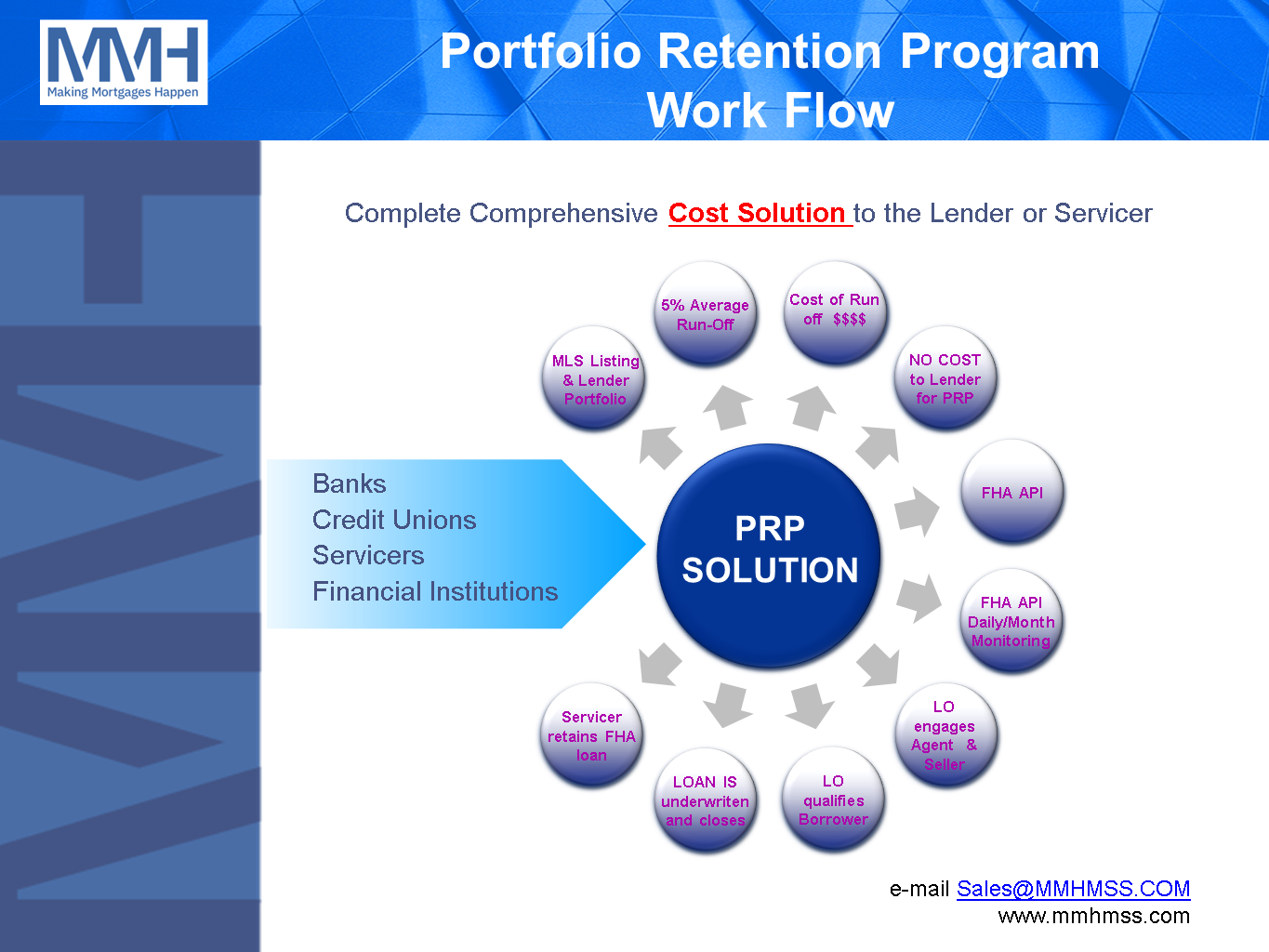

streamlines the FHA Assumption and Purchase Money 2nd TD

Process - API is installed to communicate between either the LOS or LSS process automation platform which then monitors and looks for all matches between the MLS national data bases and the existing portfolio.

When a Match is found - An automated message is created for the PRP team identifying the specific loan, property and existing borrower along with the Listing Agent. Next we communicate directly to the Listing Agent to inform them that the property / loan qualifies for an FHA assumption. Once the Listing Agent is contacted the Seller is also notified that their loan is assumable which provides a great benefit in the sales and negotiation process to attract more borrowers thus achieving full asking price.

Helping the Listing Agent & Seller - The entire work-flow is automtated and consists of a sample “Blended Rate” analysis vs. current market rate. Simultaneously, we create potential loan scenarios for borrowers showing the financial benefit of the blended rate. Lastly, a complete marketing package and website are created for the Listing Agent.

Key Benefits:

• Retain loans that you would normally lose to Run-Off

• No Cost and No Fees to Servicer

• Comprehensive “End to End Solution” to retain loans

• New borrowers get Blended Rates 1.5% to 3.0% below current market rate

• No internal staffing requirements

• New loan retention based on industry standard of 7 years

• New loan opportunity from the Seller who is now a New Buyer

PROPERTY TYPES SFR • Condominiums • Townhomes

Artificial Intelligence (A.I.) along with an automated workflow process is the next generation capability to help the Listing Agent, the Seller & the Borrower assume the existing FHA loans quickly and at lower interest rates than current market conditions provide.

The automated process works for all FHA residential loans and quickly identifies property nationwide that have been listed for with the MLS. The Listing real estate agent is immediatley identified and contacted to assist them with marketing the property as eligilble for a FHA assumption thereby delivering a lower blended interest rate making the property more desirable. Blended rates can save the new borrower hundreds of dollars per month.

With nationwide coverage, we can help Sellers, Listing Agents and new Borrowers achieve home ownership.

Complete Work Flow Solutions

Protect Against Portfolio Run-Off